Malaysia 300 Import Tax for Cars

Consequently the vast majority of cars in Malaysia are locally produced ones. In order to help you gauge the amount you have to pay for your roadtax we share in this article the latest car roadtax prices for private cars in West and East Malaysia.

Buy this car brand new pay about RM150000 deposit cash and the rest will be a new car loan that will be arranged by the dealer.

. Import duties run to as high as 300. The car is inspected by PUSKAPOM the Malaysian vehicle inspection agency. Needless to say if your car is rare or indeed not available in Malaysia these factors become paramount.

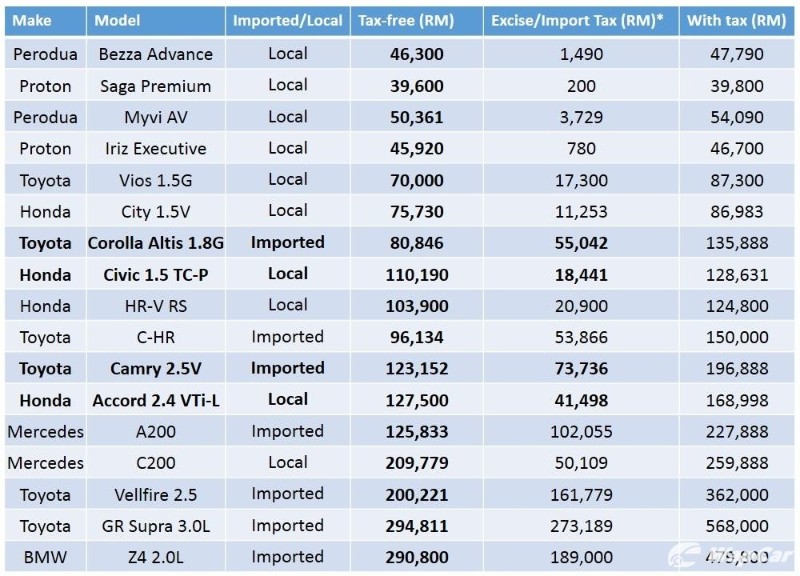

50 sales tax exemption for the purchase of imported cars also referred to as completely built-up CBU cars Currently the sales tax for vehicles is set at 10 for both locally assembled and imported cars. The SST is also applied to the importation of taxable goods into Malaysia at the rate of 5 or 10 percent or a specific rate depending on the category of products. The valuation method is CIF Cost Insurance and Freight.

The MOF announced on July 16 2018 that the Sales and Services Taxation SST is chargeable on the manufacture of taxable goods in Malaysia. IMPORT DUTY FOR PASSENGER CARS PETROL ENGINE Upto 1799 cc. So now you pay just RM150k.

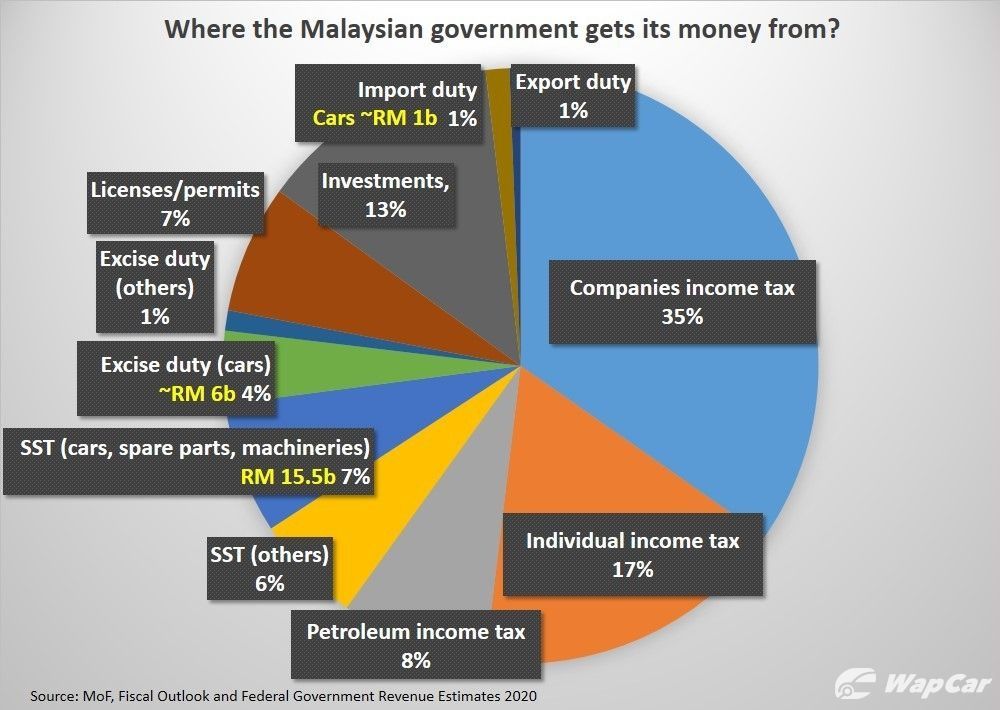

Up to 80 cash back Duties Taxes Calculator to Malaysia. Import duties are worth about RM 28 billion a year but since alcohol and tobacco contribute no more. Car Road Tax Price EN.

Now the import tax on a brand new car like this will be about RM12 million or so. 120 of the CIF value of the car will be charged for all cars having diesel engines. 03 6203 4485 03 6203 3022.

Used Audi A4 can be found in Malaysia at a pretty affordable price. To import your car to Malaysia you must apply for an Approval Permit. Consequently the vast majority of cars in Malaysia are locally produced ones.

Import duty and taxes are due when importing goods into Malaysia whether by a private individual or a commercial entity. Conditions that need to be fulfilled to qualify for an Import License for a private motor vehicle. Announces full exemption of import excise duties sales tax for EVs as part of Budget 2022.

Toyota Vellfire is sold by Toyota along with Alphard to Malaysia. 12102019 23630 pm. Duties Taxes Calculator to.

Specifics on how will this be implemented are still unclear so we will have. Analyst projects car prices in Malaysia to increase by 1-3 if GST comes into effect again Jun 09 2022. Want to save time.

Residing overseas legally for a period of not less than one 1 year. Hundreds of Japan used cars imported in Malaysia in the year of 2018. 300 of the CIF value will be charged for cars having above 3000cc engine.

2000 cc to 2499 cc. This sales tax exemption on purchases of new vehicles was previously granted from 15 th June 2020 until 31 st December 2020 and was further extended by another 6 months to 30 June 2021 by the MoF as an incentive to spur car sales at a time when the. Import duties run to as high as 300.

Finance Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz said the road tax exemption of up to 100 per cent will be given for EVs in addition to individual tax relief of up. 1800 cc to 1999 cc. Toyota Mark X Toyota Land Cruiser Honda Fit and some more are also very popular as used car in Malaysia.

3000 cc and above. For Diesel Engines Import Duty has been set as a 120 of CIF. Vehicle must be registered under the applicants name for a period of not less than nine 9 months from the date of vehicle registration to the date of return to Malaysia.

With the exemption in place it means that the sales tax is fully waived for locally assembled car or charged at 5 for imported cars. The sales tax exemptionreduction is applicable from 15-June to 31-December 2020. Cost of maintenance and parts for foreign cars are also factors to be considered.

Estimated tax free price at launch in November 2019 was RM908000 before any import taxes and options were included. IMPORT DUTY PASSENGER CARS HAVING DIESEL ENGINE. Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574.

Cost of maintenance and parts for foreign cars are also factors to be considered. We dont know the contribution of new car sales to SST collection but since a RM 50000 car customs value excise duty import duty included pays RM 5000 in sales tax it is safe to estimate that the 600000 cars sold annually contribute at least RM 5 billion in sales tax. Once the car arrives in Malaysia the owner must collect it in person from the port of entry.

Needless to say if your car is rare or indeed not available in Malaysia these factors become paramount. KUALA LUMPUR Oct 29-- The government intends to provide full exemption on import and excise duties as well as sales tax for electric vehicles EV to support development of the local EV industry. SALES TAX10 of the sum of CIF value of the car and the import duty will be charged as sales tax.

Import duty local taxes cbu ckd cbu ckd. Level 15 Block 10 Jalan Duta 50622 Kuala Lumpur. 2500 cc to 2999 cc.

It is mandatory for every car owner in Malaysia to have a valid Motor Vehicle License LKM or roadtax to legally drive on Malaysian public roads. As you already know the government has announced that it will be waiving the 10 percent sales tax for locally-assembled CKD cars while imported CBU cars will see their sales tax reduced by half to 5 percent. IMPORT DUTY ON 4X4 VEHICLES AND OTHERS.

Estimate your tax and duties when shipping from Malaysia to Malaysia based on your shipment weight value and product type. With the exemption it means that the sales tax is fully waived for the purchase of locally assembled cars while a five per cent tax is imposed for imported cars. Duties taxes on motor vehicles a passenger cars including station wagons sports cars and racing cars cbu ckd cbu ckd import duty.

In Malaysia sales tax for vehicles has been set at 10 for both locally assembled and imported cars. Currently the sales tax for vehicles is set at 10 per cent for both locally assembled and imported cars. Local taxes b other motor cars malaysia.

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Sales Tax Exemption On Passenger Cars In Malaysia How Much Will You Save

Comments

Post a Comment